company logo

North American Cannabis Technology Market

North American Cannabis Technology Market

DUBLIN, Aug. 6, 2024 (GLOBE NEWSWIRE) — “North American Cannabis Technology Market Size, Share and Trends Analysis Report” by Application (Retail & Dispensary, Cultivation & Agriculture, Processing & Manufacturing), Technology (Software, Hardware) ), the “Country and Segment Forecasts, 2024-2030” report has been added to ResearchAndMarkets.com's offering.

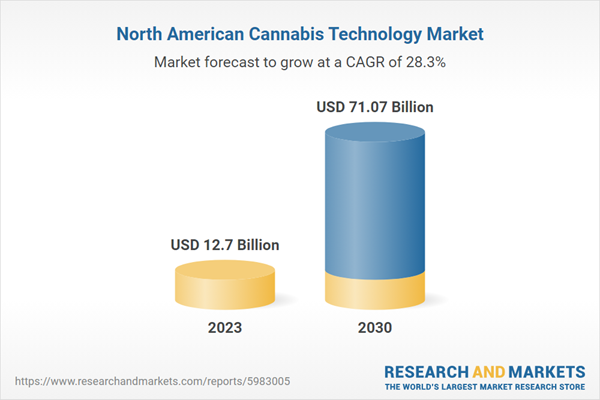

The North American cannabis technology market size is expected to reach USD 71.07 billion by 2030, registering a CAGR of 28.3% from 2024 to 2030.

The growing acceptance of cannabis among consumers has significantly increased demand for a wide range of cannabis products, including edibles, concentrates, and topicals. As more and more people become aware of the therapeutic and recreational benefits of cannabis, the market for high-quality, diverse products is booming accordingly.

This consumer trend is forcing cannabis companies to invest in advanced technology that can ensure efficient production and consistent quality of these various products. Innovations in cultivation, extraction, and processing techniques are also driving market growth.

Advanced agricultural technology is transforming cannabis production by significantly increasing yield, quality and efficiency. Precision agriculture technology uses data analysis and automation to control growing conditions and optimize plant health and productivity. IoT-based monitoring systems provide real-time insights into environmental factors such as temperature, humidity, and soil moisture, allowing producers to make informed decisions and respond quickly to problems.

Additionally, automated cultivation systems streamline processes such as watering, feeding, and lighting, reducing labor costs, minimizing human error, and ensuring consistent, high-quality production. For example, in May 2023, Fluence, a leading provider of energy-efficient LED lighting for commercial cannabis and food production, announced a medical cannabis facility to prove the feasibility of two-tier vertical farming in an urban environment. supported trichomes. Tricome worked with Fluence and its Israeli partner REMY to maximize space and optimize quality and automation. Leveraging Fluence's LED solutions and expertise, Trichome successfully designed and implemented an indoor cultivation facility.

Artificial intelligence (AI) is rapidly reshaping the landscape of the cannabis industry, pushing it into a new era of efficiency and innovation. Through advanced AI algorithms and data analytics, companies employ predictive insights to optimize every step of the cannabis production process. From cultivation to distribution to retail, AI-driven technology is revolutionizing operations by closely monitoring environmental conditions, predicting crop yields, and automating labor-intensive tasks.

Additionally, AI facilitates personalized customer experiences by analyzing consumer preferences and trends, allowing businesses to tailor products and services to evolving demands. To stay competitive, different companies are introducing different products and services that incorporate AI.

For example, in June 2023, Jointly, a prominent cannabis discovery and software company, launched Spark, a pioneering artificial intelligence model that guides individuals to achieve meaningful experiences with cannabis through intentional consumption. . By leveraging cutting-edge AI technology, Spark provides personalized recommendations and insights tailored to each user's needs and preferences.

Moreover, more domestic and international companies are entering the cannabis technology (CannaTech) space with the aim of establishing an early foothold and capitalizing on the growing market opportunity. Players are adopting various strategies such as mergers, acquisitions, partnerships, and collaborations to remain competitive. For example, in April 2023, technology company Forian announced that it would sell cannabis software provider BioTrack to Alleaves for US$30 million in cash as part of its decision to exit the marijuana industry and shift its focus to healthcare.

The move marks the second recent example of a major technology company choosing to exit the cannabis sector, citing intense competition, large-scale layoffs and declining wholesale prices for marijuana products. In August 2022, Dutchie announced Dutchie POS, a new cannabis point-of-sale platform with dual-screen terminals for dispensaries. The launch follows the introduction of Dutchie Pay, the company's payments platform. Lunche POS and Dutchee Pay provide cannabis businesses with one of the most comprehensive platforms for managing their dispensaries.

Highlights of the North American Cannabis Technology Market Report

The retail and dispensary segment dominated the cannabis technology market, holding the largest revenue share of 37.9% in 2023 due to its direct interaction with consumers and role in the cannabis supply chain.

The software segment dominated the North American cannabis technology market in terms of revenue in 2023 and is expected to witness the fastest growth during the forecast period at a CAGR of 29.0% from 2024 to 2030.

The US Cannatech market dominated the North American region with a revenue share of over 50% in 2023. Cannabis technology is experiencing significant growth in the United States due to the legalization and increasing acceptance of cannabis for medical purposes.

Featured companies

365 Cannabis

dutch

Acherna

Agrify

nugistix

rich organic

Simplifyer

Grower IQ

Distor

green line

Key attributes:

report attributes

detail

Number of pages

150

Forecast period

2023-2030

Estimated market value in 2023 (USD)

$12.7 billion

Projected market value to 2030 (USD)

$71.07 billion

compound annual growth rate

28.3%

Target area

North America

Main topics covered:

Chapter 1 Methodology and Scope

Chapter 2 Executive Summary

2.1. Market Snapshot

2.2.Segment Snapshot

2.3. Snapshot of the competitive environment

Chapter 3. North American Cannabis Technology Market Variables, Trends, and Scope

3.1. Market system outlook

3.2.Market trends

3.2.1. Analysis of market driving factors

3.2.1.1. Increased legalization and regulatory changes

3.2.1.2. Increasing consumer acceptance and demand

3.2.1.3. The rise of artificial intelligence, IoT, and big data

3.2.1.4. Increased adoption of cannabis technology and increased technological advancement

3.2.2. Market restraint analysis

3.2.2.1. Data security and privacy concerns

3.2.2.2. Supply chain disruption.

3.3.Business environment analysis

3.3.1. Industry Analysis – Porters

3.3.2. PEST analysis

Chapter 4 North America Cannabis Technology Market Segment Analysis, By Application, 2018-2030 (USD Million)

4.1. Definition and Scope

4.2. Application Segment Dashboard

4.3. Market size, forecast and trend analysis from 2018 to 2030

4.4.Retail and dispensing

4.5. Cultivation and agriculture

4.5.1. Market Estimates and Forecasts, 2018-2030 (USD Million)

4.5.2. Indoor cultivation

4.5.3. Facility cultivation

4.5.4.Outdoor cultivation

4.6. Processing/Manufacturing

Chapter 5 North America Cannabis Technology Market Segment Analysis, By Technology, 2018-2030 ($ Million)

5.1. Definition and Scope

5.2. Technology Segment Dashboard

5.3. Market size, forecast and trend analysis from 2018 to 2030

5.4.Software

5.4.1. Market Estimates and Forecasts, 2018-2030 (USD Million)

5.4.2. ERP (Enterprise Resource Planning) Solutions

5.4.3. Point of Sale (POS) Software

5.4.4. Patient/Customer Management Software

5.5.Hardware

5.5.1. Market Estimates and Forecasts, 2018-2030 (USD Million)

5.5.2. Grow Light

5.5.3. Point of Sale (POS) System

5.5.4.Greenhouse equipment

5.5.5.Trimming machine

5.5.6. Packaging and labeling machinery

5.5.7.Hydroponic system

Chapter 6 North America Cannabis Technology Market Segment Analysis, by Country, Technology and Application, 2018-2030 ($ Million)

6.1.Country Market Share Analysis, 2023 and 2030

6.2. Country Market Dashboard

6.3. Market size and forecast trend analysis from 2018 to 2030

6.3.1.Trends in major countries

6.3.2. Regulatory framework/reimbursement structure

6.3.3. Competitive scenario

6.3.4. Market Estimates and Forecasts, 2018-2030 (USD Million)

Chapter 7 Competitive Environment

7.1. Recent developments and impact analysis by key market participants

7.2. Company classification

7.3.Company Profile

7.3.1. Overview

7.3.2. Financial performance

7.3.3.Benchmarking services

7.3.4. Strategic initiatives

For more information on this report, please visit https://www.researchandmarkets.com/r/8knrvt.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

Contact: Contact: ResearchAndMarkets.com Laura Wood, Senior Press Manager press@researchandmarkets.com EST Call 1-917-300-0470 for office hours. In the US/Canada, call toll-free 1-800-526-8630. GMT For office hours + call 353-1-416-8900

Source link