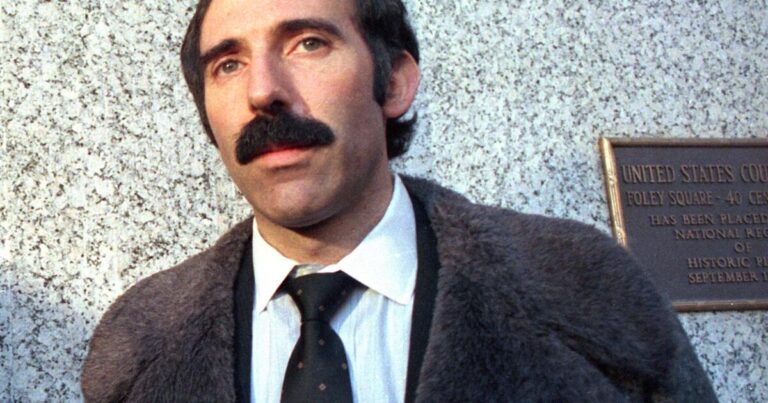

Paul A. Bilzerian was indicted by a federal grand jury in California on Thursday for allegedly evading a decades-old judgment he now owes more than $180 million to the U.S. Securities and Exchange Commission.

Bilzerian, who prosecutors say is an expert in corporate takeovers, ran the cannabis and lifestyle brand Ignite, which is said to be headed by his son Dan Bilzerian, a social media influencer. It is said that he was avoiding paying.

Bilzerian funneled millions of dollars in assets through a shell company to fund Ignite, which allegedly defrauded investors, the Justice Department announced Friday.

“On paper, Ignite's CEO was Bilzerian's son DB, a professional poker player who gained notoriety on social media for his glamorous and flamboyant lifestyle,” the U.S. Attorney's Office in Los Angeles said in a news release. “In fact, Bilzerian exercised de facto control of the company.”

Prosecutors said Mr. Bilzerian falsely stated that he was indigent to avoid paying the SEC's judgment.

Bilzerian, 74, is charged in the indictment. Ignite International Brands, a Canadian-based cannabis company. Scott Rohleder, Bilzerian's longtime accountant, was charged with conspiracy to defraud the United States, conspiracy to commit wire fraud and securities fraud, and four counts of wire fraud.

The younger Bilzerian has not been charged and is identified only by his initials on the indictment.

Lawyers for the defendants could not be reached for comment. Arraignment is scheduled for October 28th.

“This indictment alleges a long-standing pattern of criminal conduct designed to evade regulatory judgment, mislead investors, and deceive the IRS,” said the US Atty. Martin Estrada said in a statement.

The latest charges date back to 1989, when Mr. Bilzerian was convicted of securities and tax fraud violations related to three attempted takeovers. He was sentenced to four years in federal prison, but ultimately served 13 months.

The SEC subsequently filed a civil suit against Bilzerian and obtained a judgment totaling more than $62 million in 1993. Since then, prosecutors say Bilzerian has evaded law enforcement.

In 2000, a federal court held Mr. Bilzerian in contempt and appointed a receiver to recover his assets, according to the U.S. Attorney's Office in Los Angeles. The SEC recovered only about $547,000.

The judgment, including interest, now exceeds $180 million.

Prosecutors allege that from December 2018 to September 2024, Bilzerian, Rohleder and Ignite conspired to obstruct the SEC from collecting the judgment. Bilzerian is said to have operated numerous shell companies, concealing his interest in and control of those companies.

According to the indictment, Mr. Bilzerian and Mr. Rohleder oversaw Ignite's operations, strategy, marketing and financing, and held daily management meetings. Bilzerian also had influence over hiring and firing decisions for Ignite executives and board members.

According to the indictment, after federal law enforcement learned of Mr. Bilzerian's involvement with Ignite, the company issued a news release characterizing Mr. Bilzerian and Mr. Rohleder as “unpaid consultants.”

Prosecutors also allege that the defendants misled Ignite investors by inflating sales figures.

If convicted on all charges, Mr. Bilzerian and Mr. Rohleder face up to five years in federal prison on each conspiracy charge and up to 20 years in federal prison on each wire fraud charge. Mr. Rohleder faces up to three years in prison for each tax evasion charge.

On Friday, the SEC filed civil charges against Bilzerian, Rohleder and Ignite related to facts alleged in the criminal case.